NFIP and FEMA Resources

Access the most up-to-date information about the Federal Emergency Management Agency (FEMA) and the National Flood Insurance Program (NFIP) with detailed updates on current program changes, including adjustments to premium rates, revised risk-rating methodologies under initiatives like Risk Rating 2.0, and updates to coverage options and eligibility criteria.

Guidance is regularly updated to assist lenders and agents in understanding compliance requirements and navigating policy changes. This section is updated regularly to ensure you have access to the most accurate and actionable insights to make informed decisions about your flood insurance and risk management operations.

National Flood Insurance Program (NFIP)

Established by the National Flood Insurance Act of 1968, the NFIP is a federally backed initiative aimed at reducing the economic and social impact of flooding in the United States. The NFIP provides flood insurance to property owners, renters, and businesses in participating communities that implement floodplain management regulations to mitigate future flood risks.

Established by the National Flood Insurance Act of 1968, the NFIP is a federally backed initiative aimed at reducing the economic and social impact of flooding in the United States. The NFIP provides flood insurance to property owners, renters, and businesses in participating communities that implement floodplain management regulations to mitigate future flood risks.

Coverage under the program is designed to offer financial protection for damages not typically covered by standard homeowners or business insurance policies. The NFIP also plays a critical role in identifying flood risks through its Flood Insurance Rate Maps (FIRMs) and promoting risk awareness and preparedness. While it has insured millions of properties, the program has faced challenges, including financial strain from increasing flood events and the need to balance affordability with long-term sustainability.

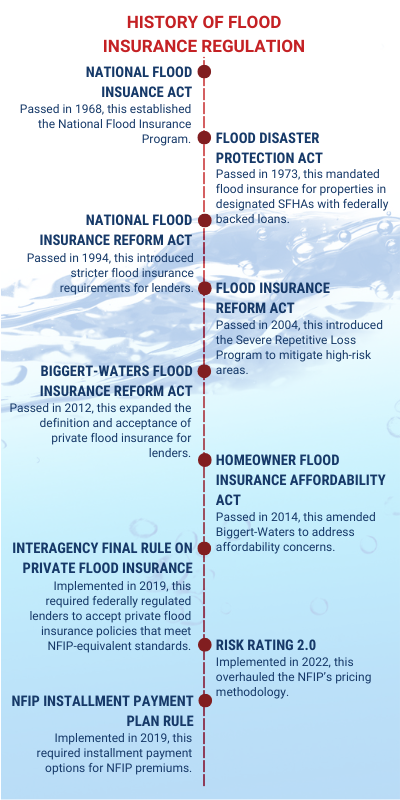

The NFIP has undergone several significant changes since its inception to address evolving challenges, improve financial stability, and enhance program effectiveness. Key program changes include:

-

Flood Disaster Protection Act of 1973: This act mandated the purchase of flood insurance for properties in Special Flood Hazard Areas (SFHAs) with federally backed loans, aiming to increase program participation and reduce dependency on disaster assistance.

Flood Disaster Protection Act of 1973: This act mandated the purchase of flood insurance for properties in Special Flood Hazard Areas (SFHAs) with federally backed loans, aiming to increase program participation and reduce dependency on disaster assistance. -

National Flood Insurance Reform Act of 1994: This act introduced the mandatory escrow of flood insurance premiums for federally regulated lenders, penalties for non-compliance, and the Community Rating System (CRS) to incentivize communities to adopt flood mitigation measures through discounted premiums.

-

Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12): Prompted by the NFIP’s rising debt, this act sought to phase out subsidies for properties at higher risk to align premiums with actual risk levels. However, affordability concerns led to public backlash and amendments.

-

Homeowner Flood Insurance Affordability Act of 2014 (HFIAA): This act revised BW-12, slowing the elimination of subsidies and introducing gradual premium increases to balance affordability with fiscal sustainability. It also provided relief for certain policyholders facing steep rate hikes.

-

Risk Rating 2.0 (Implemented in 2021): FEMA modernized premium calculations by transitioning to a methodology that reflects individual property risk rather than generalized zones, ensuring more equitable pricing based on factors like elevation, flood frequency, and proximity to water sources.

These changes were necessary to address issues like the NFIP’s mounting debt due to catastrophic flooding, underfunded policies, and outdated flood maps. They also aimed to improve fairness, enhance risk awareness, and balance affordability with the financial sustainability of the program in light of increasingly frequent and severe flood events driven by climate change.

View the current NFIP Flood Insurance Manual

Share this brochure with clients to help them understand the details of their Standard Flood Insurance Policy: NFIP Summary of Coverage

Program Changes

Effective October 1, 2021

On October 1, 2021, Risk Rating 2.0 was implemented, introducing a transformative approach to calculating NFIP premium. Key changes included:

- Equity in Premiums: Risk Rating 2.0 eliminated cross-subsidization, where lower-risk policyholders subsidized higher-risk ones. Properties with lower risks now pay less while higher-risk properties see steeper premium increases.

- Premium Caps: Premium increases are capped at 18% annually.

- Full-Risk Pricing: New policyholders are charged full-risk rates upfront, reflecting their actual flood risk.

- Increased Mitigation Incentives: Discounts are provided for properties with risk reduction measures in place, such as elevating buildings, installing flood vents, etc.

These changes were implemented to crease a more equitable, accurate, and sustainable system while improving the NFIP's financial health and resilience in the face of increasing flood risks driven by climate change.

Program Changes

Effective April 1, 2019

On April 1, 2019, the NFIP implemented several program changes aimed at improving the program's financial stability, aligning premium rates with risk, and maintaining compliance with legislative mandates. Key changes included:

- Premium Rate Adjustments: Flood insurance premiums increased by an average of 8.2% across all NFIP policyholders, with the changes varying by property type and risk profile.

- Reserve Fund Assessment Increase: This mandatory fee for Standard Flood Insurance Policies increased from 15% to 18% to ensure the NFIP could cover future claims and improve financial stability.

Additional updates were made regarding policyholder communications and claims processing, along with revised rules and guidance with the aim to enhance transparency.

Program Changes

Effective April 1, 2018

On April 1, 2018, the NFIP implemented several program changes to ensure compliance with legislative requirements, improve financial sustainability, and reflect more accurate risk assessments. Key changes included:

- Premium Rate Adjustments: Flood insurance premiums increased by an average of 8% across all NFIP policyholders, with the changes varying by property type and risk profile.

- Clarifications to Coverage: Updates were made to clarify certain policy terms, conditions, and administrative procedures to improve transparency and streamline claims processing.

These changes were necessary to address the program’s growing debt, caused by catastrophic flood events and increased claims, while ensuring compliance with federal legislation such as BW-12 and HFIAA.

Program Changes

Effective 2015-2017

The years leading up to April 1, 2018, were marked by the implementation of BW-12 and HFIAA, which aimed to balance the NFIP’s financial stability with affordability concerns. These changes gradually phased out subsidies, introduced new fees and assessments, capped premium increases, and incentivized risk mitigation, laying the groundwork for subsequent program refinements.

- Premium Increases: In 2016 and 2015, average premiums increased by 9% annually with variations based on property type and flood risk. In 2017, average premiums increased by 6.3%.

- Federal Policy Fee Increases: In 2015, the Federal Policy Fee increased to $45 for Standard Flood Insurance Policies and $22 for Preferred Risk Policies. In 2016, the Federal Policy Fee increased to $50 for Standard Flood Insurance Policies and $25 for Preferred Risk Policies, after which this fee remained consistent year-over-year.

- Reserve Fund Assessment Increases: In 2015, the RFA was increased to 10% for most policies, and in 2016 it increased to 15%.

Federal Emergency Management Agency (FEMA)

Established in 1979 and now part of the Department of Homeland Security, FEMA is the federal agency responsible for coordinating disaster response and preparedness efforts in the United States. One of FEMA's critical roles is administering the National Flood Insurance Program (NFIP), created under the National Flood Insurance Act of 1968 to reduce the financial impact of flooding on individuals and communities.

Established in 1979 and now part of the Department of Homeland Security, FEMA is the federal agency responsible for coordinating disaster response and preparedness efforts in the United States. One of FEMA's critical roles is administering the National Flood Insurance Program (NFIP), created under the National Flood Insurance Act of 1968 to reduce the financial impact of flooding on individuals and communities.

FEMA administers the NFIP by:

- Setting the rules, regulations, and premium structures of the NFIP.

- Working with private insurance companies through the Write Your Own (WYO) program to issue and manage NFIP policies, allowing private insurers to sell and service policies under FEMA's guidelines.

- Partnering with communities to promote and enforce floodplain management regulations aimed at reducing flood risks. Communities that adopt FEMA’s guidelines qualify for NFIP participation, enabling residents to purchase flood insurance.

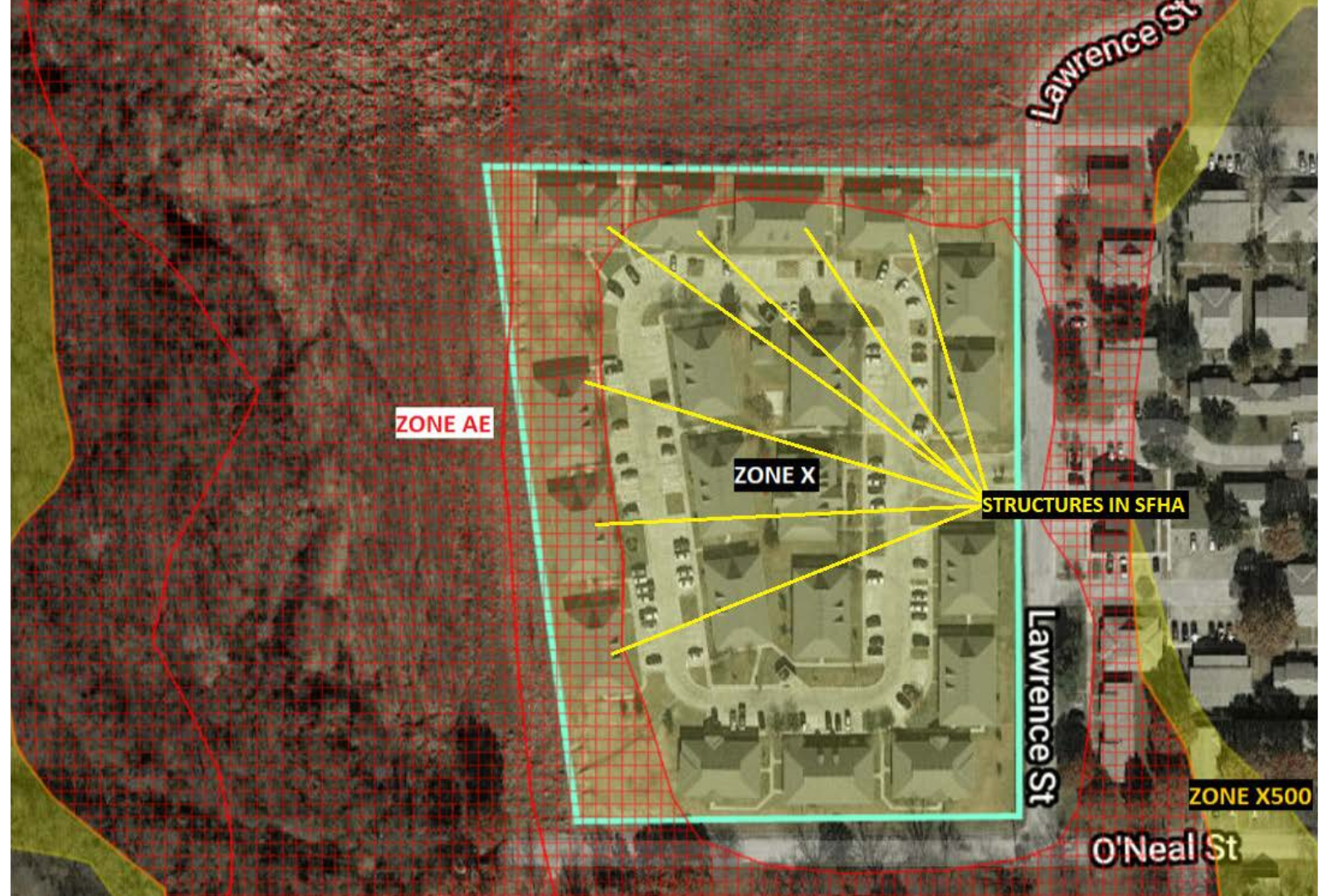

- Developing and updating Flood Insurance Rate Maps (FIRMs) to identify areas at risk of flooding. These maps help communities manage development in flood-prone areas and determine insurance requirements for properties in high-risk zones.

- Overseeing the Community Rating System (CRS), which rewards participating communities that go above and beyond in flood mitigation efforts with discounted premiums for residents.

- Overseeing the NFIP claims process to ensure timely and accurate payouts to policyholders after flooding events and managing the program's financial stability by balancing premium revenues with claim payments.

Congressional Reauthorization for the National Flood Insurance Program

Congress must periodically renew the NFIP’s statutory authority to operate. On Dec. 21, 2024, the president signed legislation passed by Congress that extends the National Flood Insurance Program’s (NFIP’s) authorization to March 14, 2025. However, it has experienced several lapses in statutory authority over the years, primarily due to Congressional delays in reauthorizing or extending the program. During these lapses, FEMA loses the ability to issue new flood insurance policies, renew existing ones, or increase coverage limits, though claims for active policies continue to be paid.

Elevation Certificates - Everything You Need to Know

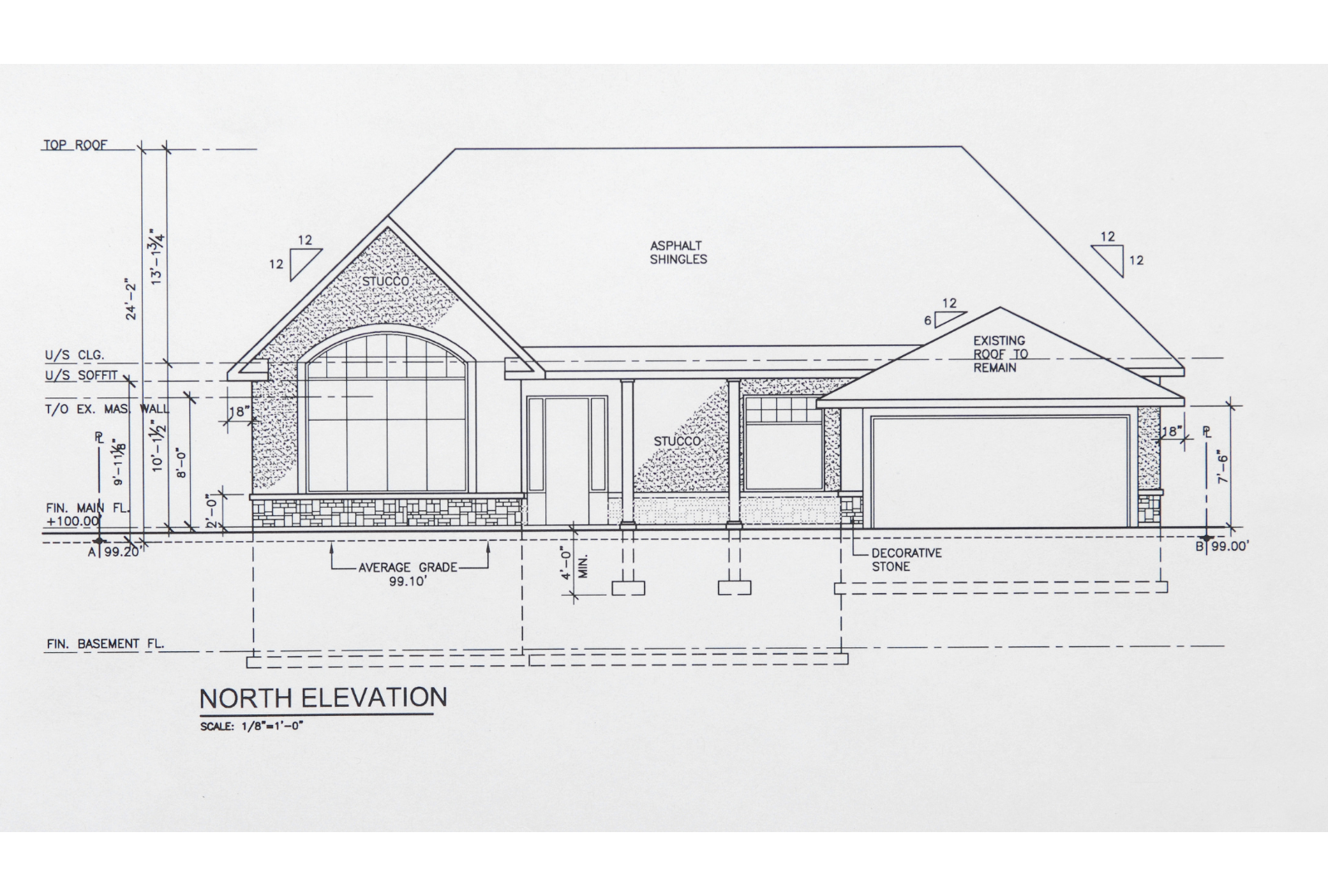

Elevation certificates have been used by licensed surveyors, engineers, and architects for years to provide critical information about a building's elevation relative to the base flood elevation (BFE) in a flood-prone area. They are primarily used to determine flood insurance premiums and ensure compliance with floodplain management regulations. Accurate elevation data can significantly reduce premiums if the building is elevated above the Base Flood Elevation (BFE). This official document also helps ensure compliance with local building codes and FEMA requirements for new or substantially improved structures in flood zones. While Risk Rating 2.0 reduces the reliance on elevation certificates for determining premiums, they are still valuable for floodplain management and insurance in many cases.

In March 2017, FEMA'S Elevation Certificate (FEMA Form 086-0-33) was revised to improve the accuracy of information collected, clarify instructions for preparers, and align the form with current flood insurance and floodplain management requirements. Key revisions included:

- Updated section fields and instructions

- Enhanced building diagram options

- Modernized certification section

These revisions helped to address compliance with digital tools, such as the use of Geographic Information system and digital mapping technologies, and ensured the certificate aligned with NFIP requirements and flood insurance rating methodologies in use at the time. They improved the reliability of elevation data collected through the form and helped reduce administrative burdens and errors in the submission process.

Letter of Map Change (LOMC)

A Letter of Map Change (LOMC) is an official document issued by FEMA that reflects changes to the current Flood Insurance Rate Map (FIRM) for a specific property or area. It is used to correct or update flood zone designations, ensuring the maps accurately represent flood risk. LOMCs can help property owners, communities, or developers resolve discrepancies and may impact flood insurance requirements and premiums.

LOMCs are vital tools for maintaining accurate flood maps, helping property owners and communities manage flood risk effectively, and ensuring compliance with federal floodplain regulations.

Types of LOMCs:

-

Letter of Map Amendment (LOMA):

- Used when a property or structure has been inadvertently included in a Special Flood Hazard Area (SFHA) but is naturally above the Base Flood Elevation (BFE).

- Often requested by property owners to remove mandatory flood insurance requirements if their structure is found to be at lower risk.

-

Letter of Map Revision (LOMR):

- A formal revision to the FIRM, typically initiated when there have been physical changes to the land (e.g., new levees, drainage improvements) or when better data becomes available.

- It can apply to a specific property, multiple properties, or larger areas.

-

Letter of Map Revision Based on Fill (LOMR-F):

- Requested when fill material has been added to a property to raise its elevation above the BFE.

- Commonly used for developments or construction projects to mitigate flood risk and reduce flood insurance requirements.

-

Conditional Letter of Map Revision (CLOMR):

- Issued before physical changes (e.g., construction or development) are made, providing FEMA’s review and approval of proposed projects that may impact the FIRM.

- Not a final revision; a LOMR is required after construction is completed.

-

Conditional Letter of Map Revision Based on Fill (CLOMR-F):

- A pre-construction document that outlines FEMA’s conditional approval of using fill to elevate land above the BFE.